The shale technologies have changed the prospects for natural gas in the country

By Ellis Talton

This past February was the 1 year anniversary of the first liquified natural gas (LNG) shipment from the United States. The dramatic moment was the culmination of a fast and relatively unexpected about-face in the world’s energy industry: the discovery and production of shale gas in the US. An industry that was once looking at import-only projects to bring natural gas into the country has now re-purposed its facilities to export, and to do so in a major way.

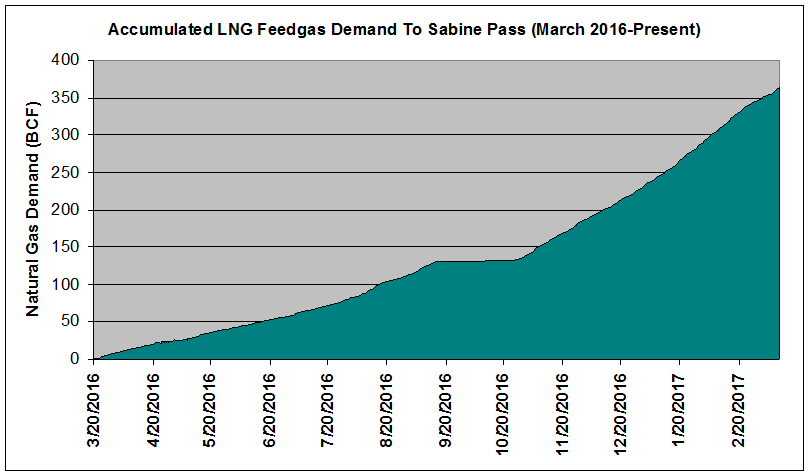

The US currently has only two facilities that are dedicated to LNG exports: ConocoPhillips’ plant in Kenai, Alaska and Chenerie’s Sabine Pass facility in Sabine, Louisiana. Sabine Pass is the larger of the two and was the site for the US’ first LNG export. Sabine Pass has continued to be a heavy exporter of natural gas since coming online and has been an important mechanism for balancing domestic natural gas prices and preventing huge stockpiles of excess supply. Before the export option, excess natural gas supply would remain in the US, and was beholden to weather patterns and US-based consumers. Now with the ability to serve the international markets, excess supply will no longer remain in the country. Sabine Pass alone contributed to nearly a third of the draw-down from excess storage last year, and is showing increasing demand for pipeline natural gas in the US.

Source: Celsius Energy

As is with all domestic pipeline infrastructure, the Federal Energy Regulatory Commission is responsible for all of the environmental impact studies and approvals for LNG facilities in the country. While Alaska and Louisiana are home to the only two exporting facilities in the US, FERC has been busy the last year eyeing more LNG facility paperwork. As of March 2017, seven new facilities are under construction, another four have already been approved and are in the pre-construction phase, and finally another thirteen are putting their paperwork through the FERC offices to get approval. In total, the United States is on track to see its export capacity grow from the current two facilities doing 1.6 bcf per day to 24 facilities doing 40.3 bcf per day, a 2,500% increase.

The Energy Information Administration predicts all facilities will be completed by 2020 and will make the US the 3rd largest exporter of LNG behind Qatar and Australia. The timeline is likely possible given the current administration’s favorable stance to these types of projects. In addition, the facilities are being built in regions of the US that are unlikely to receive much negative political feedback. For example, of the eleven facilities currently approved, 6 are in Louisiana, 3 are in Texas, 1 is in Maryland and the other in Georgia. Texas, Mississippi, and Florida will also see facilities being built.

These facilities will help to stabilize the domestic supply and demand balance of natural gas and will prevent massive storage surpluses that could drive prices down to dangerously low levels. It will also give many producers in the US access to international markets and international prices. Asian hub prices, for example, can fetch around $10.00 per mmbtu while Henry Hub only hovered around $2.60 per mmbtu in 2016. It is a great arbitrage opportunity as long as those prices in international markets hold.

Ellis Talton is a New York Energy Week 2017 Fellow. He worked as an energy journalist for The Oil & Gas Year in Istanbul, Turkey and covered the Middle East and Africa. He graduated from The University of the South: Sewanee with a Bachelor’s of Arts in French Studies and a focus on international relations.

Ellis Talton is a New York Energy Week 2017 Fellow. He worked as an energy journalist for The Oil & Gas Year in Istanbul, Turkey and covered the Middle East and Africa. He graduated from The University of the South: Sewanee with a Bachelor’s of Arts in French Studies and a focus on international relations.