Follow the money. It’s good advice in law enforcement, politics, and finance. It’s just as true in the energy industry. To see the energy industry of tomorrow, look at where money is flowing today. Just looking at energy financing, the revolution is well underway. Already the majority of energy financing and new energy sources are in the renewables and investors are asking fossil fuel companies about stranded assets.

Where the Money is Flowing

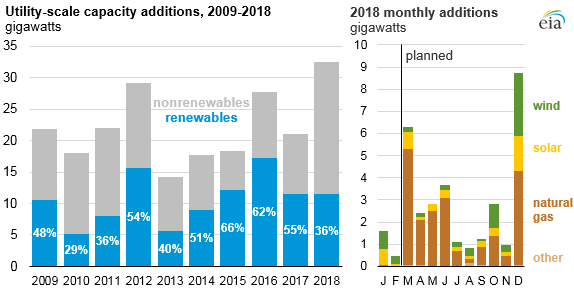

According to the Energy Information Agency, in the United States renewables account for the majority of new generating capacity in every year since 2013. The EIA projects that in 2018 there will be more new natural gas capacity but that is probably a blip rather than a long term change. The main reason for the change is the collapsing price of renewable energy. Since 2009 the price of utility scale solar systems has fallen by 85%. Onshore wind has fallen by two thirds in the same time. At these prices renewable energy is already below the cost fossil fuels in some cases.

Source: U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory. 2018 monthly US energy additions

Fossil fuel prices have not fallen at the same rate. In the United States, companies are closing coal plants instead of opening them. In the rest of the world only China is building a lot of new coal plants and even they are building one third the number they were. American companies are still increasing their natural gas production but at a slower rate than during the height of the shale boom a few years ago.

Why the Change

There are a lot of reasons driving change and they fall into two broad categories: government regulation and market forces.

Government Incentives

Governments around the world have policies to promote renewable energy. In the US, the federal government provides tax incentives for renewables. As well, many state governments have renewable energy mandates on their utilities. This push and pull dynamic contributes to the rapid increase in the renewable energy in the country. During the recent tax reform debate congress decided to keep tax credits for renewables until around 2022. There are so many federal and state programs for renewables that diving into them could cover multiple blog posts (California alone has 188) but essentially governments in the US have provided various incentives for companies and individuals to invest real money in renewables.

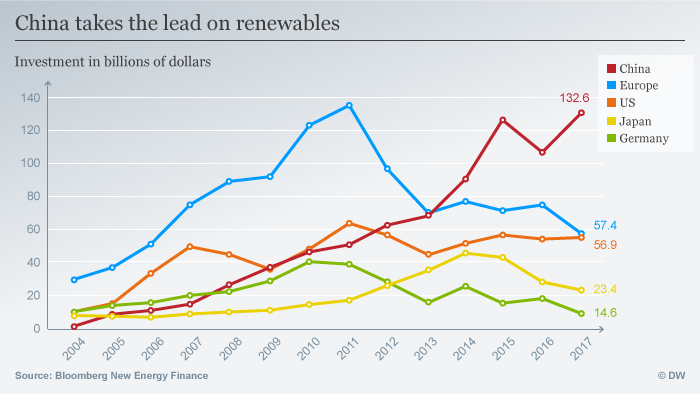

Source: Image: Bloomberg New Energy Finance. China has made a big bet on renewables.

Governments in other regions have incentivized investments in renewables even more heavily. China is aggressively promoting renewables, including some of the worlds most ambitious clean energy projects. The Chinese government, through subsidies, incentives, and targets, has spent more promoting renewable energy than the US and EU combined. Their activities have enabled economic of scale that have dramatically cut the cost of solar panels.

Source: Getty Images. A panda shaped solar facility in Datong, China

Market Forces

More and more large companies are looking to purchase renewable energy. This includes technology companies such as Facebook and Google, consumer facing companies like Lego and Mars, and as my colleague Ajay has written many others have pledged to go 100% renewable as well. Consumers are driving rooftop solar deployments and, in a growing number of places, signing up for community solar projects. These trends involve upfront investment costs combined with long term payoff that eventually reduce costs for consumers. The collapse in renewable energy prices means that investment and financing are now pouring into the sector. This is why 90% of investment comes from private sources today.

Stranded Assets

Lastly, we need to ask where the money is flowing from. More important, we need to ask if money is trapped where it is. Investors certainly seem to think so. Increasingly they are asking fossil fuel companies about their stranded assets. A stranded asset is an asset that becomes obsolete or non-performing before the end of its useful life. Companies have to write off stranded assets because they end up having no value.

The term is a fairly new way of discussing fossil fuels in the context of climate change. Basically, fossil fuel companies have trillions in undeveloped assets (oil and gas fields or coal deposits) that they have earmarked for future development. However, as the energy ecosystem changes and to avoid the catastrophic effects of climate change, many of these assets can never be developed. In fact, according to “Unburnable carbon 2013: Wasted capital and stranded assets” 60-80% of all coal, oil, and gas reserves held by publicly listed companies are “unburnable” if we want to avoid catastrophic climate change.

What does this mean for investors, pension funds, and banks? According to JP Morgan, fossil fuel companies have $27 trillion in reserves. If they keep 80% in the ground, that means $20 trillion become stranded assets. Given the size of the industry, the risk could be a massive hit to investors, and in fact to anyone with a retirement account. Banks have reduced, but not eliminated, their exposure to coal and have increased their due diligence for oil and gas companies. Considering the increasing risk to banks and investors of their investments being trapped in the ground, they need to understand their exposure to stranded assets and whether they can absorb the hit of asset write downs.

Summing it up

Investment is flowing rapidly into renewable energy. For many years governments drove investment into renewables. However, in the last few years prices for solar and wind turned competitive with traditional fossil fuels in many places. Today market forces are mostly driving the deployment of renewables and research into new technologies. More and more investors are asking whether fossil fuel companies can safely develop their assets. There is a real risk that companies aren’t yet pricing in this risk.