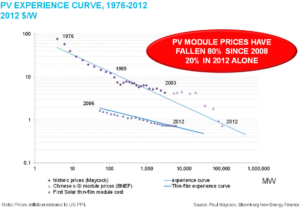

Gone are the days when solar panels were so expensive that you would only see them on the rooftops of wealthy people who wanted their houses to look like they were from the future. Incredible advancements in technology and production processes have brought the price of the panels down. As the total capacity of solar photovoltaic panels has increased from less than 10 MW in 1976 to more than 100 GW in 2012, their price per Watt has plummeted from almost $100 to less than a dollar.

Some experts believe that the cost decline will continue along the established path, as manufacturers get better at making ever more efficient panels. However, today, the solar industry must focus on other parts of their business model, namely, the so-called “soft costs,” to continue offering better deals for the customers.

According to the estimates of National Renewable Energy Laboratory, hardware costs in 2012 made up less than 45% of the total installation cost. At the same time, financing, although declining, still remains a major part of the cost structure for solar developers.

Solar finance has been a persistent thread of New York Energy Week since its inception in 2013, and this year, panelists will talk about topics such as tax equity structures and solar securitization at our Solar Breakfast, “Bending the Curve: Future Pathways for Financing Distributed Solar,” on Tuesday, June 14.

With solar investment tax credits extended through 2021, tax equity financing will remain an important part of allowing the solar industry to grow. According to Bloomberg, about $11.5 billion of tax-equity deals for solar and wind were made in 2015, up 14% from the figure in 2014. Although new investors have entered the market, the fact that tax equity deals, because of their complicated structure, have to be large enough to be attractive to the few blue-chip investors that can use the equity to offset their large tax bills, some experts fear that the growth in demand for tax equity could outpace the supply. While SolarCity, for example, can amass a large number of projects into large-scale tax equity financing deals, such as the $188-million one in April 2016 with Bank of America Merrill Lynch, along with an unnamed investor, smaller developers might not be able to access the necessary capital.

Solar securitization deals, where solar developers would offer securities backed by long-term receivables from rooftop leases, have also continued growing. In March 2016, SolarCity alone sold $235 million in such solar-powered bonds, and analysts believe the market is poised to continue expanding, as new developers join the crowd. For example, Sunrun took in $111 million in its first securitization in 2015, and others, including Vivint Solar, Sunnova, and Sungevity, have been named as potential newcomers in the near future.

According to some estimates, the U.S. is set to install twice more solar panels in 2016 than it did in 2015. Available and affordable financing will a key factor determining the so far remarkable growth of solar industry in the U.S.