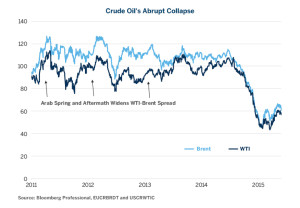

The spectacular rise in U.S. crude oil production and OPEC’s market-share response led to a collapse in oil prices. As crude oil inventories rose, market participants grabbed oil at lower prices and stored it in the hope of selling at higher prices in the future in a contango market. In addition, there has been strong demand for crude as refiners take advantage of high crack spreads and ramp up gasoline production ahead of the summer driving season. In response, the price of West Texas Intermediate (WTI) Crude is 30% above its lows in January and March. Given the soaring inventories, will oil prices collapse again after the peak summer demand? The answer may be in the hands of American drivers and their counterparts around the world.

In his latest research piece “Oil Set to Fall After Summer Driving Season?” CME Group Executive Director and Senior Economist Erik Norland explores factors affecting crude oil prices, including the potential impact of this summer’s driving season.

View more reports from Erik Norland, Executive Director and Senior Economist of CME Group.