NY generates 60 percent of its electricity from natural gas

By Janis Kreilis

Last week, the New York State Department of Environmental Conservation (NY DEC) denied approval to Northern Access, an approximately 100-mile pipeline that would have transported natural gas from the Marcellus shale in Pennsylvania to the Erie County in New York, connecting to additional markets in the Midwest and Canada.

The developer of the project, National Fuel, had been working with the NY DEC for 34 months to solve engineering and environmental challenges related to the crossing of streams in the way of the pipeline.

As for the reason for not issuing a water quality certification and wetland permits and thereby rejecting the $500-million project, the NY DEC stated that Northern Access would have “adverse impacts to wetlands, streams, and fish and other wildlife habitats.”

The company’s CEO Ronald Tanski was stern in his statement in response to the decision, raising concerns about “the ability of utilities in the state to meet the future energy needs.”

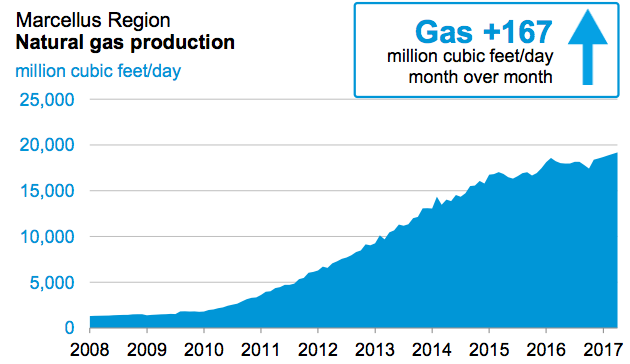

As the price of natural gas in the U.S. has fallen thanks to the boom in production from the Marcellus and other shale regions in the nation, a growing number of electricity generators have been converted from coal to gas, in addition to a large number of new natural gas-fueled plants built in recent years.

Marcellus gas production, March 2017. Source: EIA.

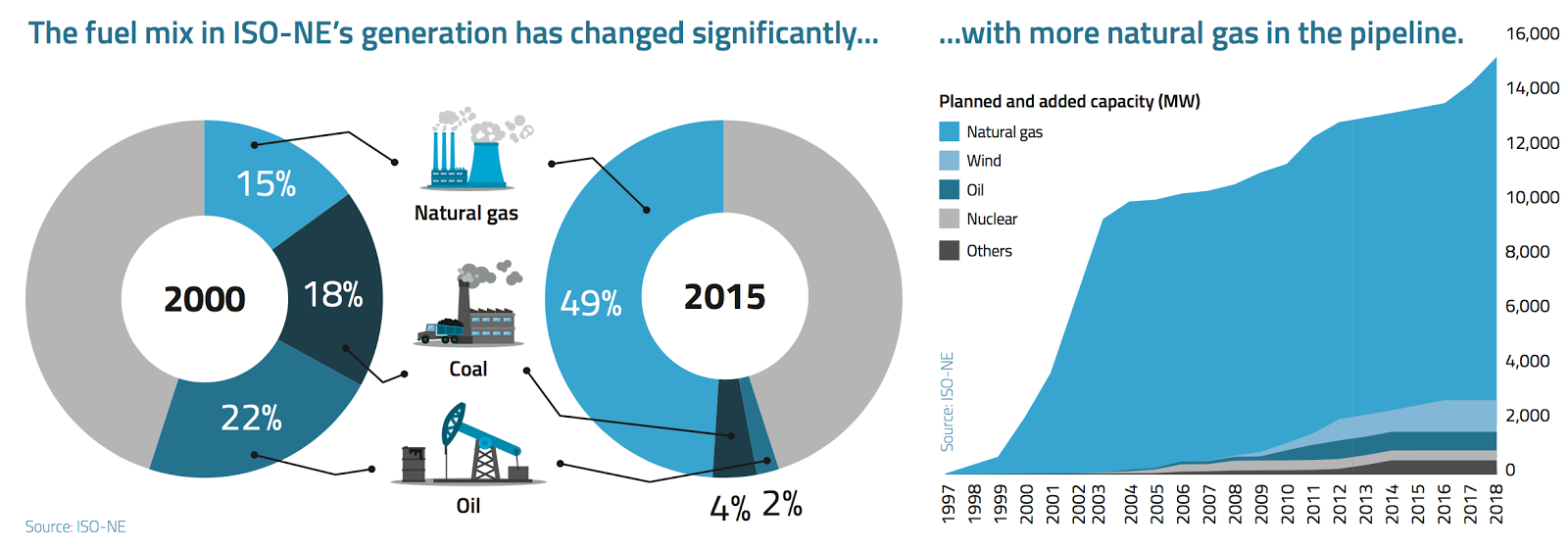

As a result, the fuel mix in the electricity markets in the Northeast and the Midwest, namely, ISO-NE, NYISO, and PJM, has changed considerably. New York currently generates about 60 percent of its electricity from natural gas, and the figure stood at close to 50 percent for New England in 2015. More gas-fueled capacity is planned for 2017 and 2018.

Fuel mix and capacity additions in ISO-New England. Source: ISO-NE via EnerKnol.

In October 2016, both PJM and ISO-NE voiced their concerns that local opposition to the development of natural gas pipeline infrastructure could adversely impact the reliability of the electric grid in the region. Other projects, such as Duke Energy’s Atlantic Coast Pipeline, have faced protests or court battles, as was the case with Spectra Energy’s Access Northeast project, where the Massachusetts Supreme Judicial Court forbade the Department of Public Utilities to approve contracts making electric utility customers pay for the development of gas pipelines.

Meanwhile, environmental advocates would rather see renewable energy and demand-side management increase their share in the generation mix, arguing against expanded pipeline capacity. The Natural Resources Defense Council has described the several projects in the region as “wasteful buildout of unnecessary oil and gas infrastructure”, especially in the cases where paths have to be cleared for the right-of-way of new pipelines. The Council has also warned of explosions and gas leaks that can occur more frequently if the infrastructure is expanded. And ultimately, the question is about greenhouse gas emissions – although methane is a cleaner-burning fuel than oil or coal, it does not have the same track record as solar or wind power.

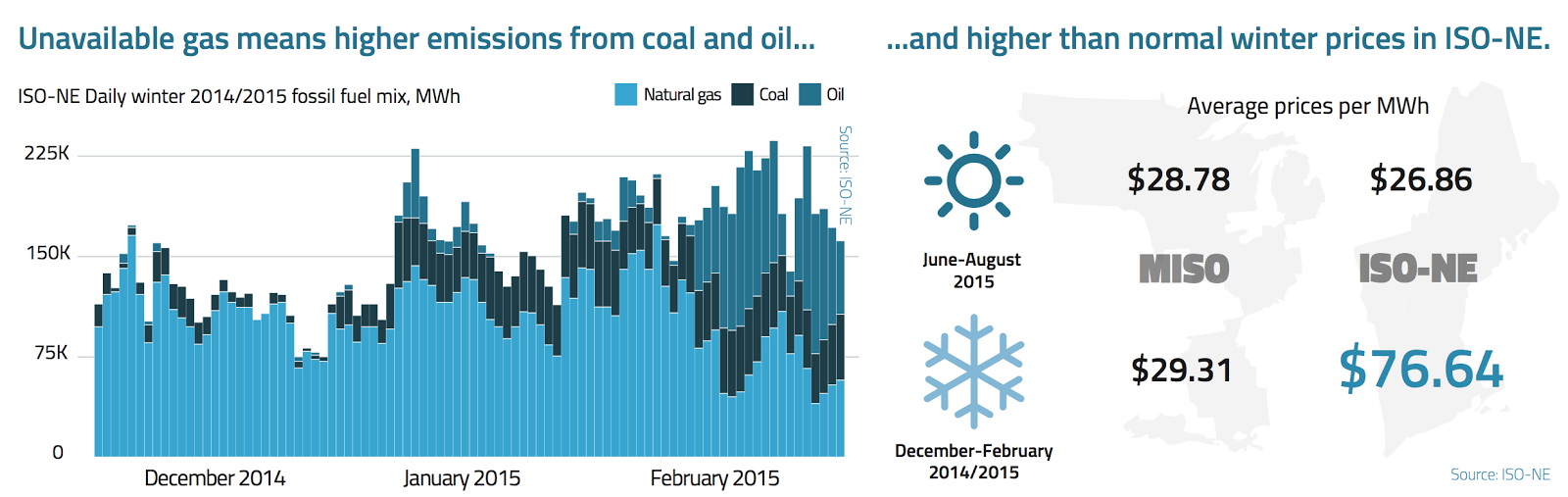

However, with the existing supply mix, not having the gas when it is needed most – typically, in the winter months – means that generators have to switch back to oil. Consumers pay extra during the peak demand periods when the constrained capacity occasionally makes prices shoot through the roof.

Fuel mix and prices in ISO-NE in 2015. Source: ISO-NE via EnerKnol.

The debate on expanded pipeline capacity epitomizes the status of natural gas as a transition fuel from the “dirty days of coal” to the clean energy future. On one hand, gas is clearly better for the environment than coal or oil, and the current shale gas boom provides a great opportunity to switch from the environmentally worst fossil fuels to the best. On the other, there is the hope that solar, wind and other renewables would allow us to cease relying on fossil fuels altogether. As with many other issues, so it seems, the main question on expanded pipeline capacity is “when?”