Federal government approves pipeline expansion for natural gas

By: Ellis Talton

In January 2017, the Federal Energy Regulatory Commission (FERC) approved Spectra Energy’s Atlantic Bridge expansion project– a proposal to increase natural gas pipeline capacity on the Algonquin Gas Transmission system. This pipeline network is a key piece of infrastructure to the northeast region and carries 3.08 billion cubic feet of natural gas per day over 1,129 miles of pipeline through New Jersey, New York, Connecticut, Rhode Island and Massachusetts.

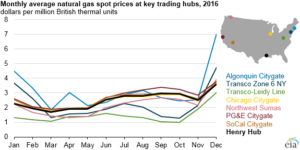

The northeastern United States is notorious for having some of the most volatile natural gas prices in the country– a result of harsh winters and constrained natural gas transmission systems. This is despite the fact that natural gas prices in 2016 were the lowest since 1999, averaging about $2.49 per mmbtu. Although low, prices were also the most volatile. Proponents of the project expect that this expansion, which is part of a larger development called Access Northeast, will help to alleviate some of the volatility seen in the region and bring prices in line with the rest of the country. For example, prices at New York’s Transco Zone 6 spiked from around $1.50 per mmbtu in October 2016 to almost $5.00 per mmbtu in December. This is not as extreme as spikes seen at the Algonquin Citygate trading hub in Boston (which saw prices of almost $8.00 per mmbtu in December), but is significantly more than the other six major spot trading hubs in the country.

This first wave of the Algonquin expansion will build about 6.3 miles of new pipeline and a compressor station in Massachusetts, adding a total of 0.13 billion cubic feet per day by November 2017. The larger Access Northeast Project plans to boost the capacity of the six major pipeline networks operating in the Northeast and Canadian-Atlantic regions.

These systems include the Maritimes and Northeast (M&N) Pipeline; a joint-owned M&N and Portland Natural Gas Transmission System (PNGTS); the Algonquin Gas Transmission Company; another PNGTS-owned system; the Tennessee Gas Pipeline Company, which supplies New York City; and the TransQuebec and Maritime pipeline, which serves Canada. The Access Northeast Project is slated for a 2018 finish and will spend around $3 billion to bring 1 billion cubic feet per day of natural gas into the region. The Access Northeast Project will also add regional liquified natural gas (LNG) storage in New England, at least enough to provide up to 5 gigawatts of electricity generation. This project still faces a number of regulatory and political hurdles, but regulators and operators, including ISO New England, should welcome improved natural gas transmission systems, at least in the short term.

Midstream Business, an online news source owned by Hart Energy, sees this project as a broader business development effort to take advantage of natural gas being produced from the Marcellus Shale plays and capture demand market growth in the Northeast.

And according to Spectra, which in February 2017 merged with Enbridge, this is the only proposed project in the region focused on improving reliability for hydrocarbons-produced electricity. New York State is looking at a number of upgrades in its backyard as well. ISO New England outlines seven different pipeline projects that have either been approved or are awaiting approval. Despite these upgrades and expansions of hydrocarbons-based transmission systems, New York State will require half of all electricity generated in the state be via renewables by 2030.

___

Want to add something about the Atlantic Bridge project? Are there future topics you’d like to see a post about? Contact me: team2017@nyenergyweek.com | Enerknol Data Platform

Ellis Talton is a New York Energy Week 2017 Fellow. He worked as a energy journalist for The Oil & Gas Year in Istanbul, Turkey and covered the Middle East and Africa. He graduated from The University of the South: Sewanee with a Bachelor’s of Arts in French Studies and a focus on international relations.

Ellis Talton is a New York Energy Week 2017 Fellow. He worked as a energy journalist for The Oil & Gas Year in Istanbul, Turkey and covered the Middle East and Africa. He graduated from The University of the South: Sewanee with a Bachelor’s of Arts in French Studies and a focus on international relations.