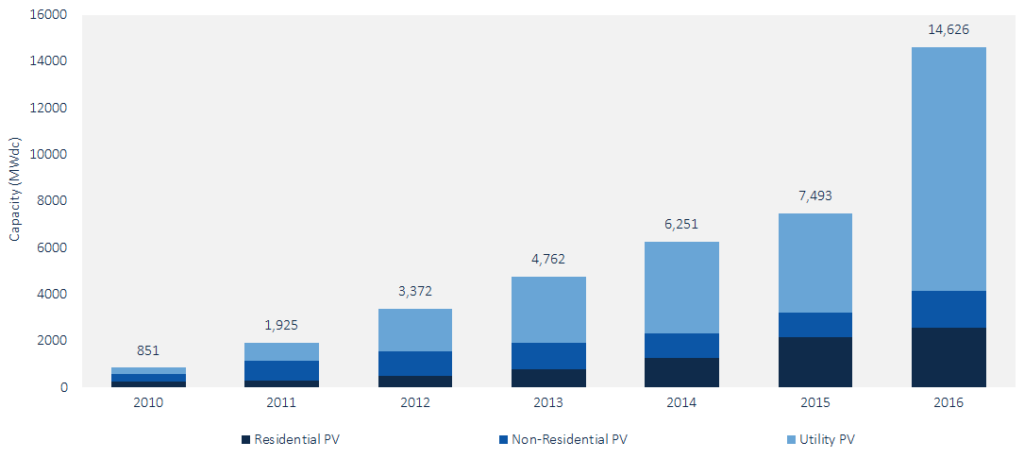

Each year, for almost the last 30 years, the cost of harnessing energy from the sun has gotten 10% cheaper. This trend shows no signs of slowing down, making solar energy cost competitive to other energy alternatives and resulting in solar breaking US records as the largest capacity addition by energy source in 2016. The majority of those gains have been in residential and utility-scale solar, which caused Bryan Birsic, CEO of start-up company Wunder Capital to wonder: if the hardware costs are plummeting, why isn’t the commercial market growing at similar rates?

US Solar PV Installations 2010-2016, Source SEIA US Solar Markets Report

Taking a look at all of the hard and soft costs of solar energy that were published in a 2012 Rocky Mountain Institute report, the team was able to discover data that could be incorporated into superior algorithms to address inefficiencies. It came down to financing. Banks who would normally lend to a customer to install solar energy systems lacked the sophistication to adequately quantify the risk profile of the installment, and relied on assessing the business alone and credit history. And project finance companies who invest in solar are looking for deals in the $2-20M range; much larger than the $0.5-1M needed for commercial scale projects. Therein lay Wunder’s sweet spot.

Starting a company that deploys hardware from a software perspective enables a plethora of places to optimize processes and expand the addressable market. Underwriting is a very expensive and necessary process to assess the risk profile of an investment. Application program interfaces can scrape data that could be relevant to assessing or procuring a potential project such as assessing the energy consumption profile or factoring in seasonality. This saves human time to filter projects that have red flags, allowing for a more efficacious use of underwriters. Once there is a deal, the cost of executing the deal through the digitization of the paper trail allows legal costs and billing to stay down. The expenses of maintaining and managing a project are kept to a minimal with an efficient back end database. The cost of acquiring a customer can also remain low with search engine optimization. Most importantly, 85-95% of the businesses who wanted to install solar did not have access to a deal platform. In other words, profitable projects today stand idle because the money on the sidelines can’t fully appreciate the opportunity or risk.

As I consider trends to identify the winners and losers in the rapid global energy transformation, one thing is abundantly clear. The winners are those who are smart about using data to connect the dots. The winners are not those who need to retrofit a technology from the past to be able to survive in the present, but are nimble enough to design a scalable process – whether hardware or software – that is poised to leverage the future. When a company uses data to take advantage of hardware which is rapidly declining in cost and is a clear favorite for delivering a carbon free source of energy (something we need a whole lot more of to solve climate change) to develop a new investment class that can deliver up to 8.5% returns with a minimum $1,000 investment… well, it is a winner.

Ask Birsic what the world looks like in 10 years and he will tell you:

“Putting passions about climate change aside… as a business owner with an open rooftop, you are breaking your fiduciary duty if you haven’t considered installing solar.”

Indeed, and in many cases, that same statement holds true today.

___

Christophe Jospe is a policy wonk who tries to think like an engineer and investment banker. He is on a quest to unleash funding and amplify attention to the most promising solutions to manage carbon. He holds a BA in Political Science from Colgate University and an MPA in Environmental Science and Policy from Columbia University.

Christophe Jospe is a policy wonk who tries to think like an engineer and investment banker. He is on a quest to unleash funding and amplify attention to the most promising solutions to manage carbon. He holds a BA in Political Science from Colgate University and an MPA in Environmental Science and Policy from Columbia University.