Regulatory uncertainty in the United States clean energy market has, in no uncertain terms, damaged long-term industry growth. Despite the hype surrounding clean energy, still just over 5 percent of the U.S. energy mix is supplied by solar and wind sources. A lack of regulatory certainty has stymied research and development and smothered financing options, with fewer stakeholders willing to take the risk of investing in a volatile industry.

The regulatory environment of the energy industry has been discussed throughout the years at New York Energy Week. And, again, this year it will permeate several events throughout the week. It will be an important component of our Solar Breakfast, entitled “Bending the Curve: Future Pathways for Financing Distributed Solar,” which will take place on Tuesday, June 14. And policy and regulatory conditions will also continue to affect how we innovate and expand the concept of demand side management. So these issues will certainly arise during the Demand Side Management Future event on Thursday, June 16.

The U.S. clean energy sector is highly contingent on a stable regulatory and legislative environment. Signals created through these mechanisms send reverberations throughout the business community that can drastically affect clean energy investments.

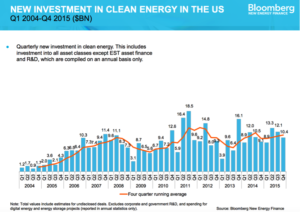

Since 2011, clean energy investment in the United States has remained surprisingly stagnant. This is, in part, due to a lack of regulatory uncertainty at the federal level. The Renewable Energy Production Tax Credits (PTC) for both solar and wind energy have played a big part in determining certainty in the market. The Renewable Energy PTC has been around since 1992, but there have been numerous disruptions, and the credit has lapsed several times. These disruptions have hurt the industry, as developers need some certainty when deciding to undertake large infrastructure projects. In 2013, these tax credits were allowed to expire briefly, resulting in new wind farm installations dropping by 92% and causing a loss of 30,000 jobs across the industry. In a separate instance, in 2014, Congress effectively extended the credit for only two weeks, despite it requiring years for the energy industry to develop projects, secure financing, and sign power purchase agreements. So this lack of certainty has recently resulted in static progress throughout the industry, as evidenced below.

Conversely, fossil fuels have historically and consistently been heavily subsidized. According to an October 2011 report by Management Information Services, Inc. – a Washington-based consulting group – the oil, coal, and natural gas industries have received a combined $594 billion in incentives from 1950-2010. Renewables – primarily wind and solar energy sources – have only received $74 billion.

There is a domino effect at play, here. To cause the necessary tectonic shift in U.S. energy generation that will drive clean energy investment and combat a changing climate, the federal government must continue to demonstrate its willingness to support long-term investment and research and development.

Recent steps by the federal government seem promising. In December 2015 Congress extended the Renewable Energy PTC for five years, providing certainty to the clean energy market that has not been seen for some time. The Investment Tax Credit for solar provides a 30 percent credit for projects under construction by December 2019, with an incremental reduction to 10 percent by 2022. The 2.3-cent per kilowatt-hour Production Tax Credit for wind was extended through 2016, with 20 percent reductions each year through 2020. These extensions were widely heralded as huge steps forward for the clean energy industry that will support ten of billions of dollars in new investment and hundreds of thousands of new jobs in the United States.

Elsewhere, however, uncertainty still looms. The Clean Power Plan, one of the Obama Administration’s preeminent triumphs on tackling climate change is being vehemently fought in the courts. Since the final version of the plan was unveiled in August 2015, 24 states have collectively sued the Environmental Protection Agency, stating that the plan is an illegal attempt to “reorganize the nation’s energy grid” and unduly punishes the coal industry, which will lead to higher electricity costs. Arguments are set for June 2nd before the U.S. Circuit Court of Appeals in Washington, D.C. The plan was supposed to take effect this year, but a stay will remain in effect until the U.S. Circuit Court of Appeals decides the case or the Supreme Court decides on appeal. Until then, the clean energy industry will continue to hang in limbo, unable to more fully realize its potential.

Legislative and regulatory signals play a critical role in helping the clean energy industry advance new technologies, drive down costs, and forecast for the future. Without long-term certainty, the clean energy industry cannot make the necessary investments to spur innovation.

The rise of clean energy is inextricably tied to our ability to combat a rapidly changing climate. The more information and certainty that can be provided to the clean energy industry, the greater its ability to scale, leading to increased production and decreased costs that are eventually passed onto consumers. Demanding regulatory certainty within the clean energy industry is fundamentally crucial to our goals for developing more sustainable energy sources, combatting climate change, and creating the kind of world we can be proud of in the future.

So what awaits us in the midst of an evolving regulatory environment? We, at New York Energy Week, don’t have all the answers. But we believe we provide one of the best forums for policymakers, businesses, investors, and other stakeholders to come together and converse on these important issues.

We look forward to you joining us!

Read more at New York Energy Week.